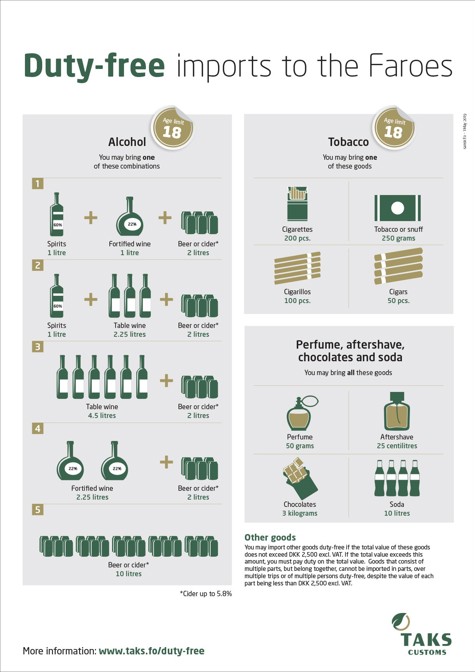

Travellers to the Faroes are permitted to bring the following for own consumption without paying tax and duty. You may bring the following allowance once within 24 hours. The minimum age for bringing alcohol or tobacco is 18 years.

Alcohol

- 1 litre of spirits over 22% ABV (at most 60% ABV) + 1 litre of fortified wine up to 22% ABV + 2 litres of

- beer or

- cider up to 5.8% ABV

- or 1 litre of spirits over 22% ABV (at most 60% ABV) + 2.25 litres of table wine + 2 litres of

- beer or

- cider up to 5.8% ABV

- or 2.25 litres of fortified wine + 2 litres of

- beer or

- cider up to 5.8% ABV

- or 4.5 litres of table wine + 2 litres of

- beer or

- cider up to 5.8% ABV

- or 10 litres of

- beer or

- cider up to 5.8% ABV

Tobacco

- 200 cigarettes

- or 100 cigarillos

- or 50 cigars

- or 250 grams of tobacco

Perfume, aftershave, chocolates/sweets and soda

- Perfume, 50 grams maximum

- Aftershave, 25 centilitres maximum

- Chocolates/sweets, 3 kilograms maximum

- Soda, 10 litres maximum

Other goods

You may import other goods duty-free if the total value of these goods does not exceed DKK 2,500 excl. VAT. If the total value exceeds this amount, you must pay duty on the total value. Goods that consist of multiple parts, but belong together, cannot be imported in parts, over multiple trips or of multiple persons duty-free, despite the value of each part being less than DKK 2,500 excl. VAT.